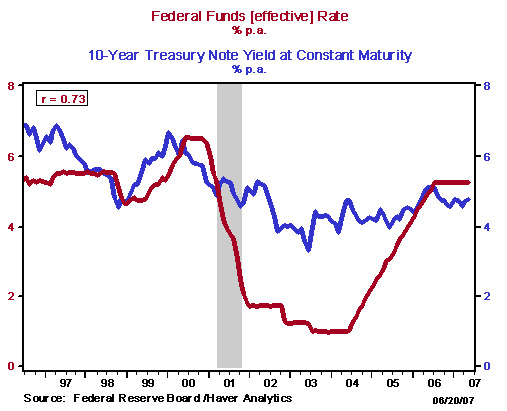

Given the relatively small size of the federal funds market, why are all short-term rates tied to the federal funds rate? – Education

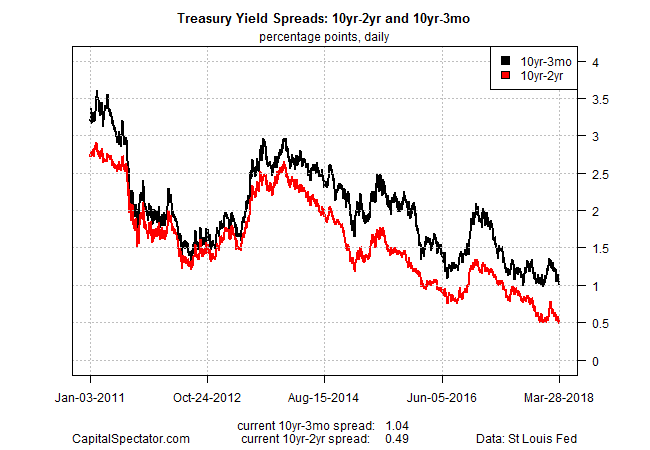

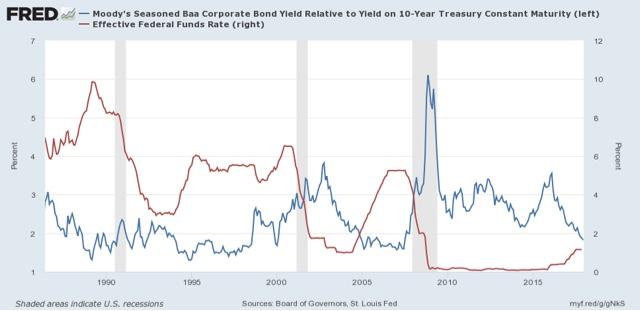

The Bond Yield Conundrum Revisited: Narrowing Corporate Spreads Vs. A Flattening Treasury Yield Curve | Seeking Alpha

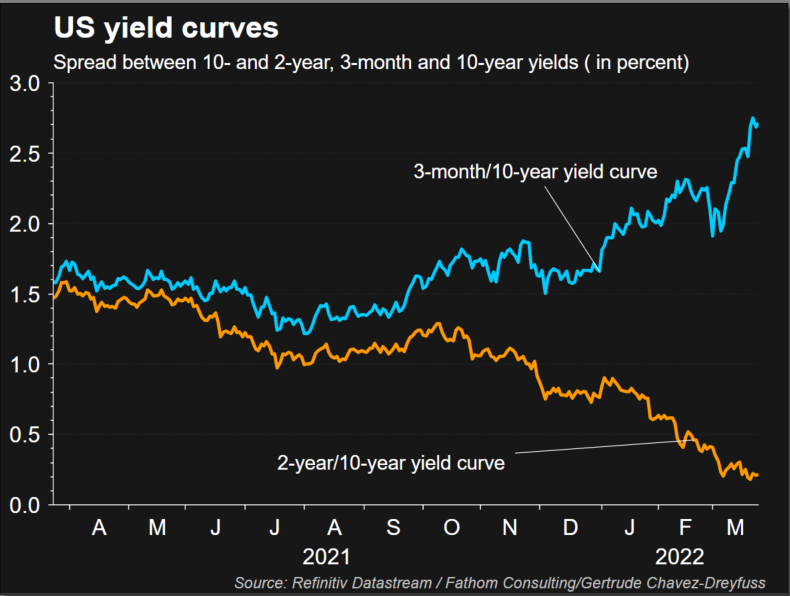

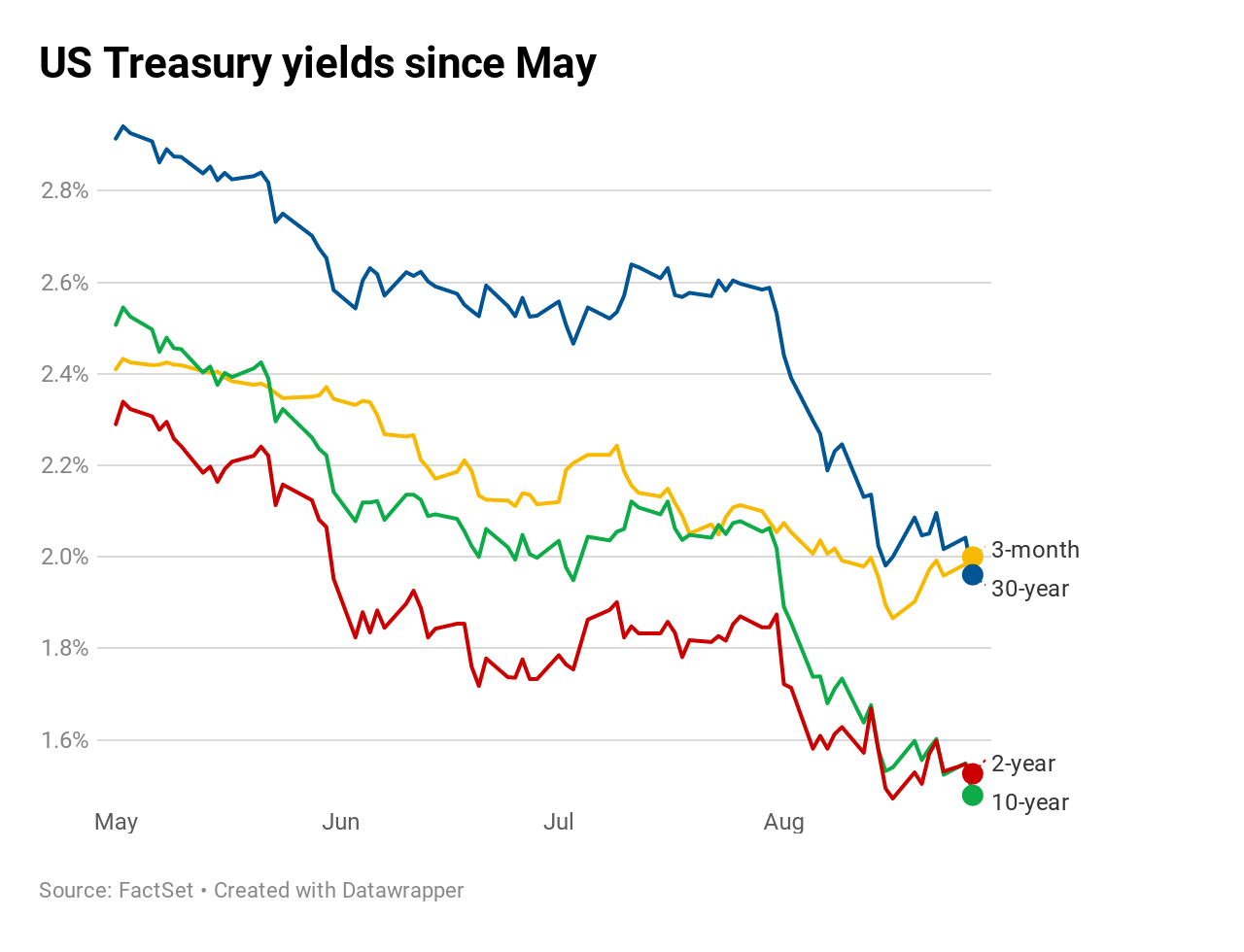

Fed Meets to Set Rates: Fed Raises Rates Half a Point as It Tries to Tame Inflation - The New York Times

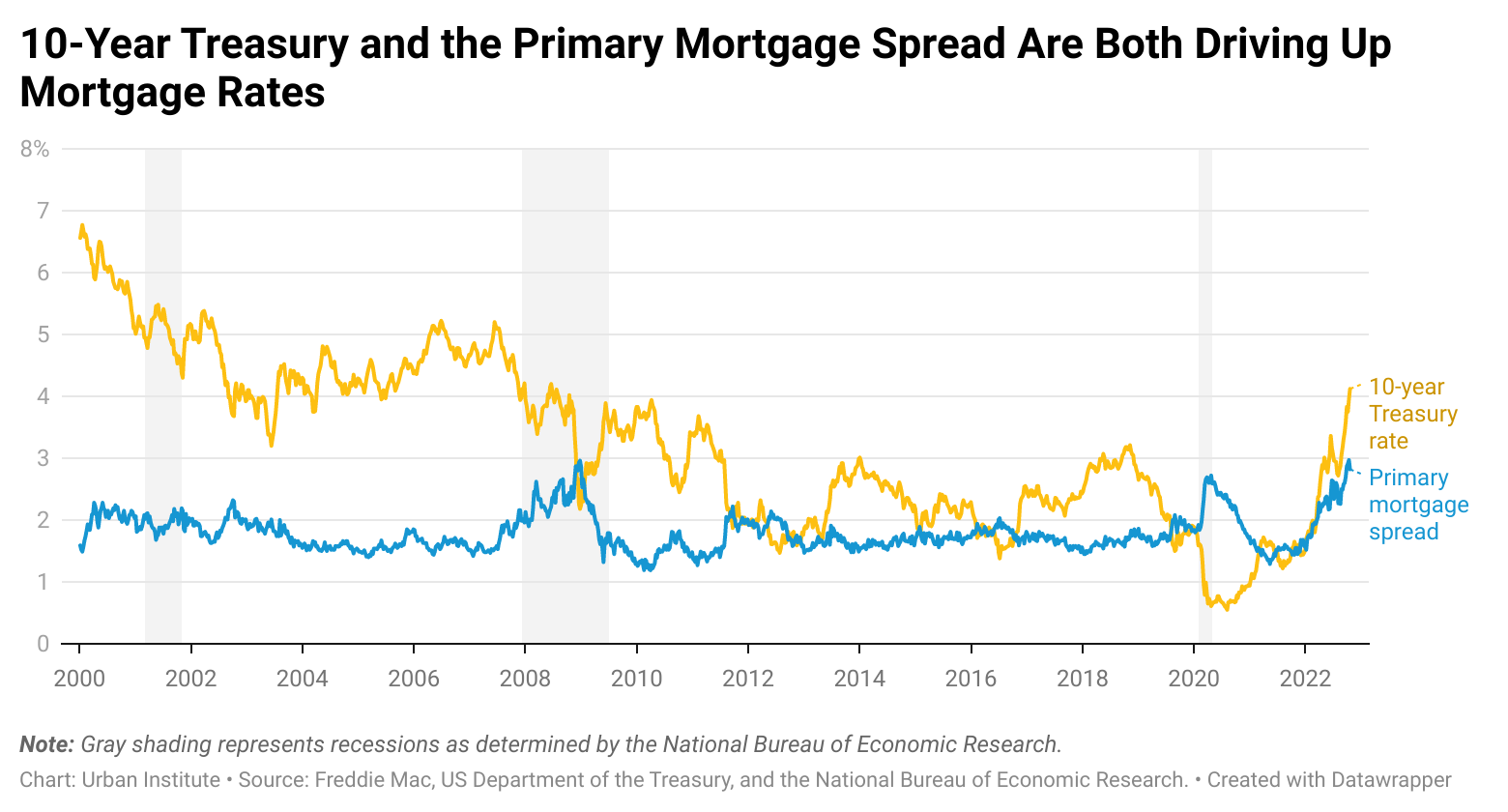

.1566488000880.png?w=929&h=523&vtcrop=y)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)