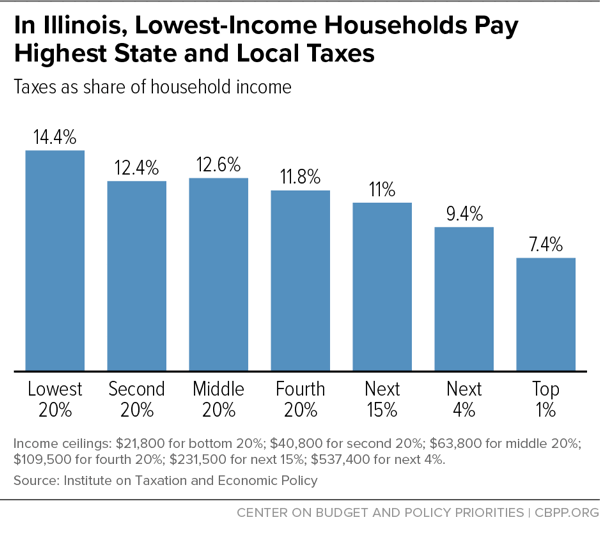

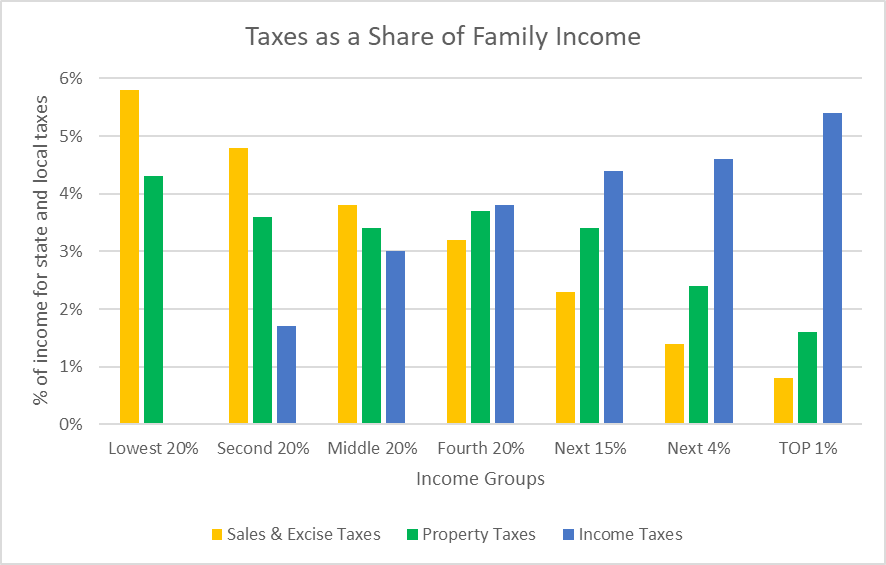

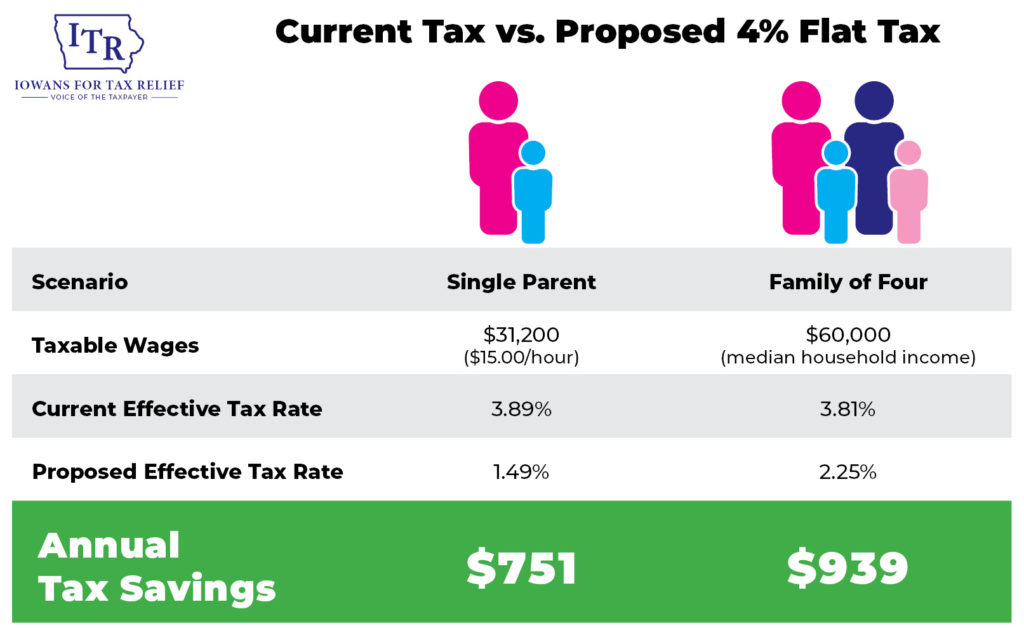

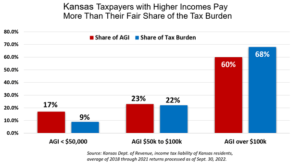

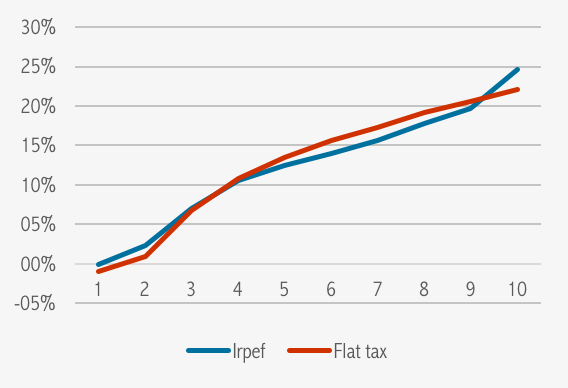

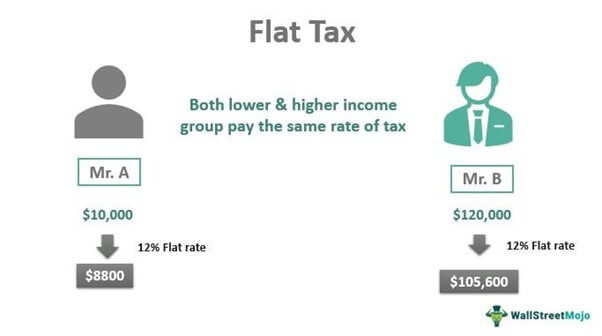

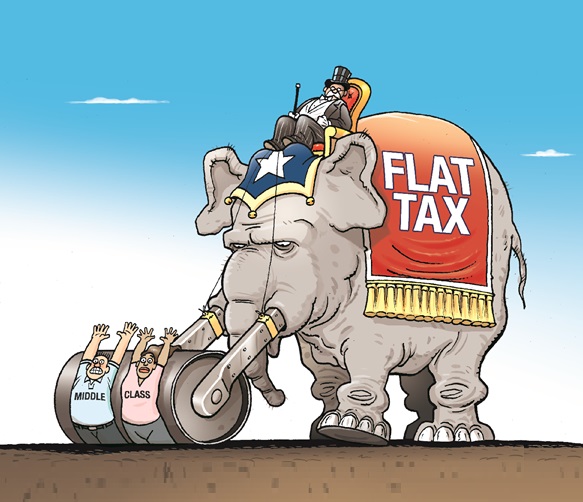

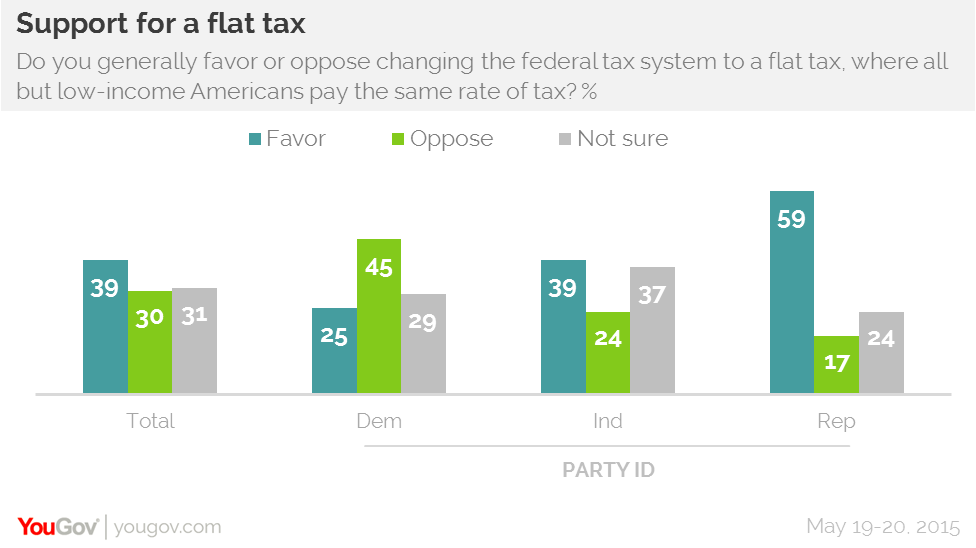

The proposed GOP "Flat Tax" would generate about $1T in taxes, almost entirely from those making between $35k-$135k. It would also generate $20B in income from those earning above $700k. : r/Political_Revolution

Tax analyst says flat-rate system will benefit wealthy at the expense of the majority - Wisconsin Examiner