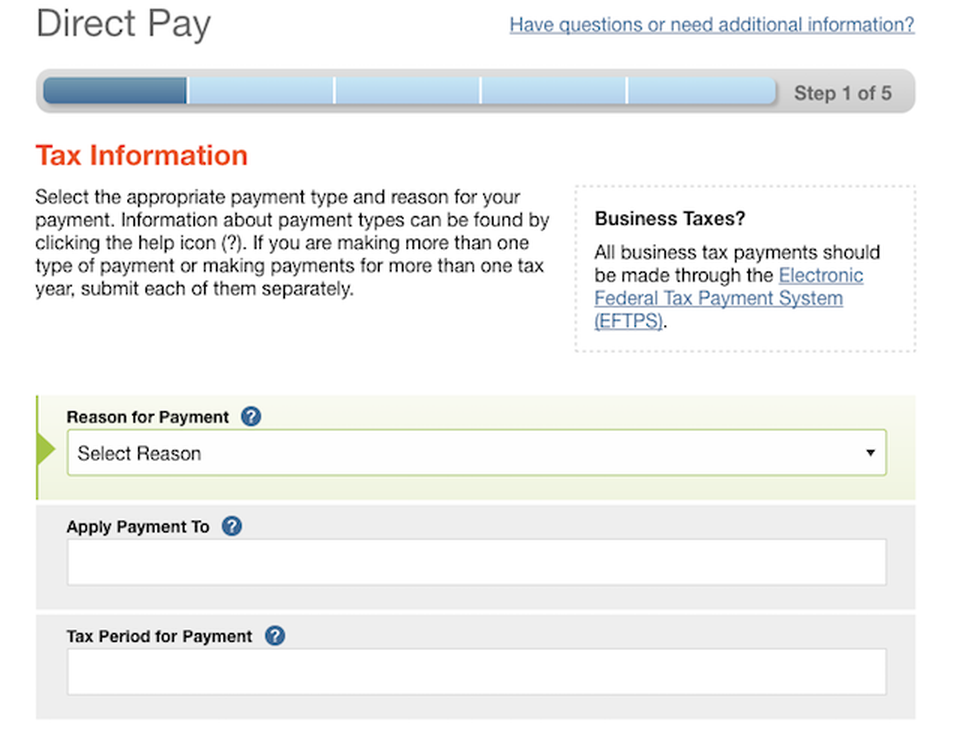

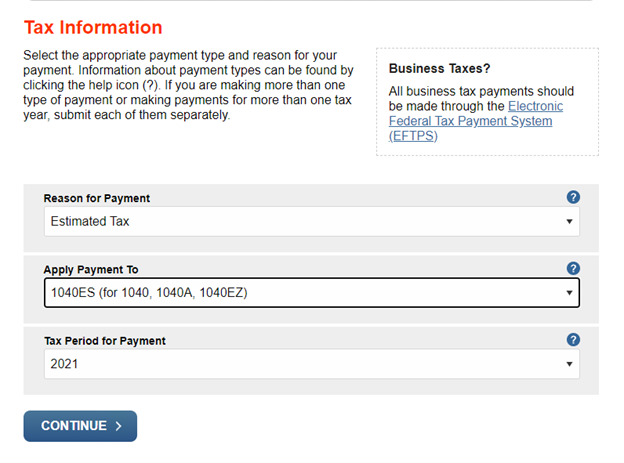

How to pay the IRS online. Pay income taxes. Pay the IRS taxes online, by mail. Pay 1040 online - YouTube

Some IRS online services, including ways to pay estimated taxes, are working despite shutdown - Don't Mess With Taxes

IRSnews on Twitter: "Taxpayers in many places will not need to report special state payments on their 2022 federal tax returns. See the latest # IRS update at: https://t.co/640REwlVlJ https://t.co/npLSsyd7un" / Twitter

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)