Ten Important Points to Remember About International Estate Planning for Persons with Connections to the United States

New Federal Estate Tax Exemption Amount (Updated 2023) | Opelon LLP- A Trust, Estate Planning And Probate Law Firm

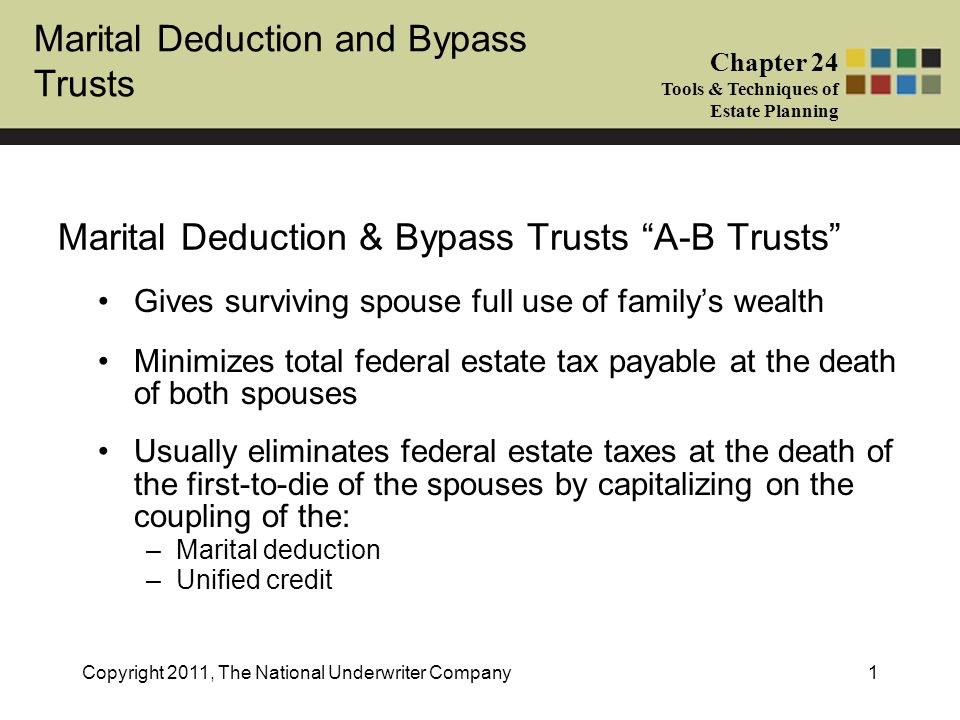

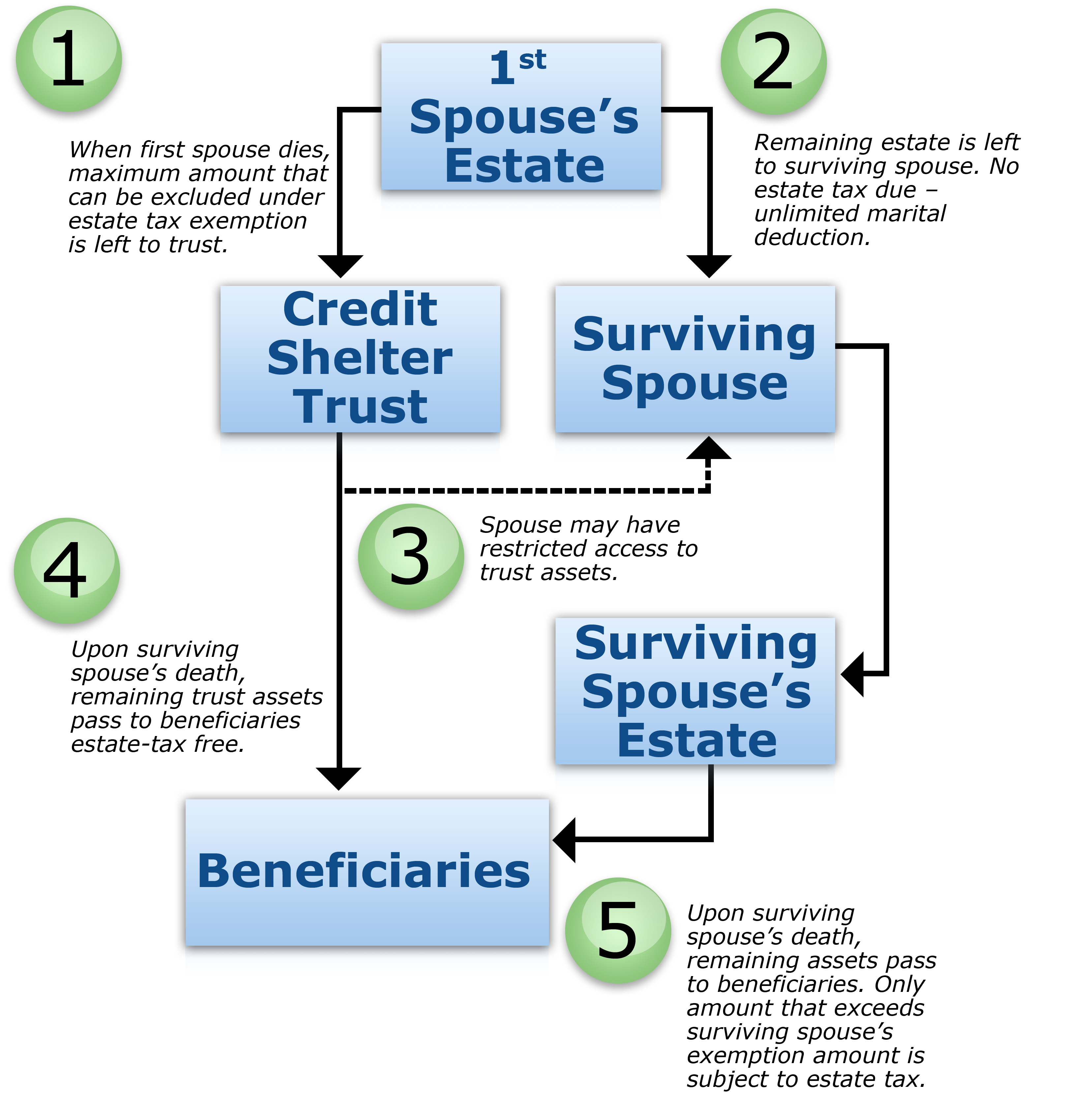

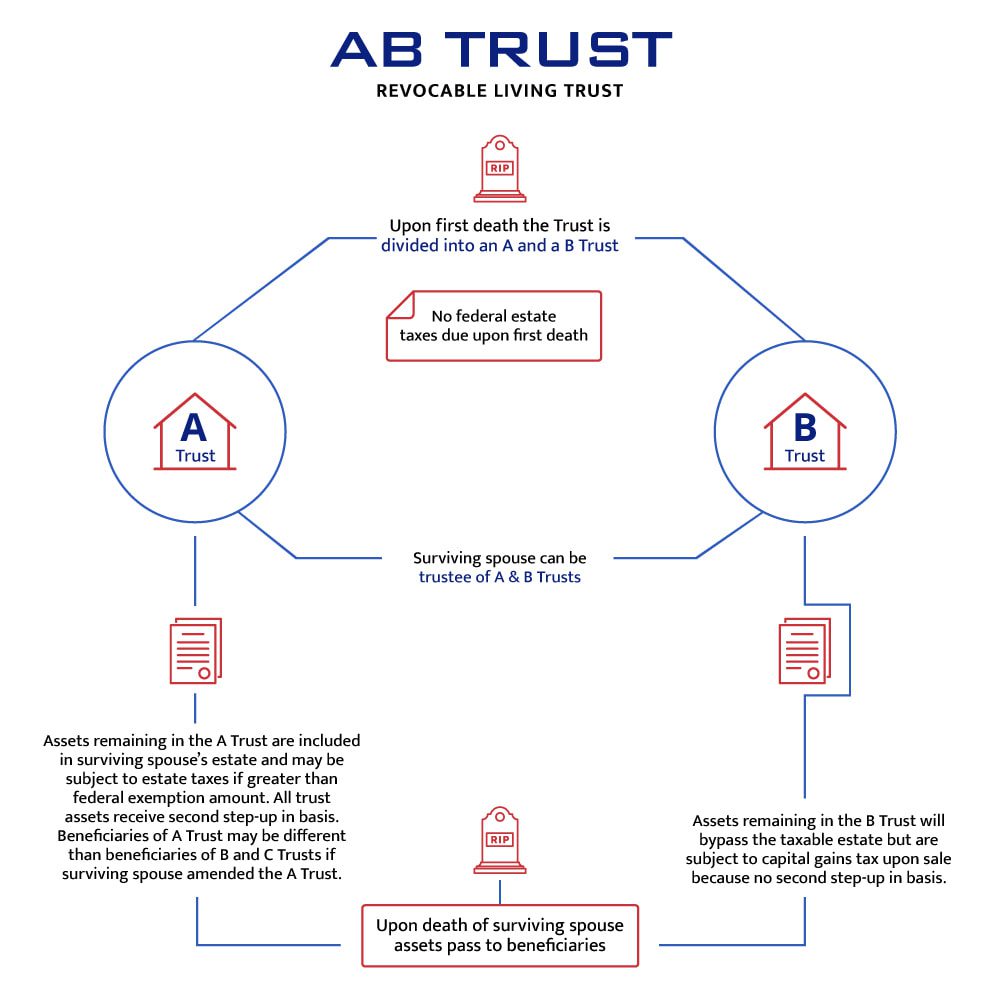

Free Report: What is the Estate Tax Marital Deduction? - Litherland, Kennedy & Associates, APC, Attorneys at Law

TSB-M-11(8)M:(7/11):Implementation of the Marriage Equality Act Related to the New York State Estate Tax:tsbm118m

Federal Estate Tax-Determination of Marital Deduction in Community Property State When Surviving Spouse Elects to Take Under Dec